News

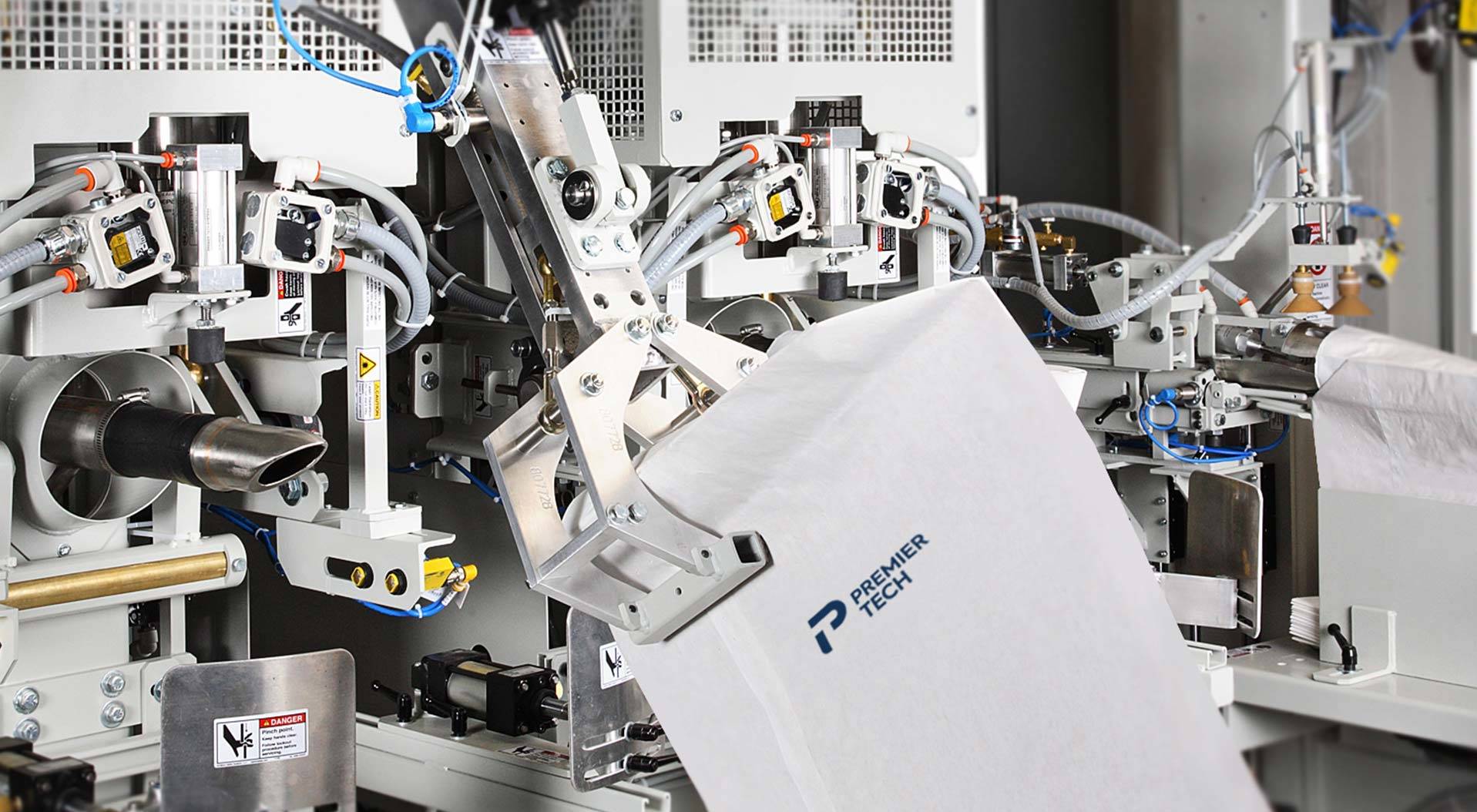

Premier Tech and Bühler jointly launched a new fully automatic bagging machine specially designed for powdery products. This machine offers maximum productivity through reliable, fully automatic operation, outstanding bagging accuracy, and high product and operational safety.

Read more